Taking loan is one of the easiest ways to do. At the end of this article you will be able to take loan on NTC and Ncell.

Table of Contents

Considering the customers’ convenience, both Ncell and NTC have started Credit/Loan or Saapati services. This has helped many customers in time of emergency when the balance suddenly becomes low. Although the nature of the service is similar, all telecom operators have variables on it. Furthermore, a lot of people are still not acquainted with the process of taking loans on their respective carriers. Here, In this article we will discuss about the steps on how we can get loan in Ncell and NTC.

For what can you use the loan amount?

- Voice Calls

- SMS

- Data

Now, let’s jump into the Credit services and their features given by two of the biggest telecommunication giants in Nepal: NTC and Ncell !

NTC Loan/Credit Service:

Nepal Telecom is a Government-owned pioneering Telecom operator of Nepal. Nepal Telecome started its credit service in 2018. Nepal Telecom is mostly known by the short name NDCL or Ntc or NT or Doorsanchar (in Nepali). It has almost all telecom services, available throughout the country. It is also the one and only Landline (Home phone)/PSTN service provider in the country.

Features of NTC Loan Service:

- No Call drop: If you activate the Ntc loan service, then your call will not drop due to no balance issue. Similarly, there will be no extra charges for the activation of the loan service.

- NTC allows loan amounts of up to NRs. 40.

- The same amount will be deducted once the user recharges their mobile balance.

- To take a loan again, you will have to clear up the previous loan amount.

- To use the service, the SIM must be in use for at least three months.

- You can use the loan amount for voice calling and data packs.

How to Take Loan on NTC and Ncell?

How to take a Loan in NTC?

Taking a loan on NTC is fairly easy. It only requires a few basic steps. Check them below:

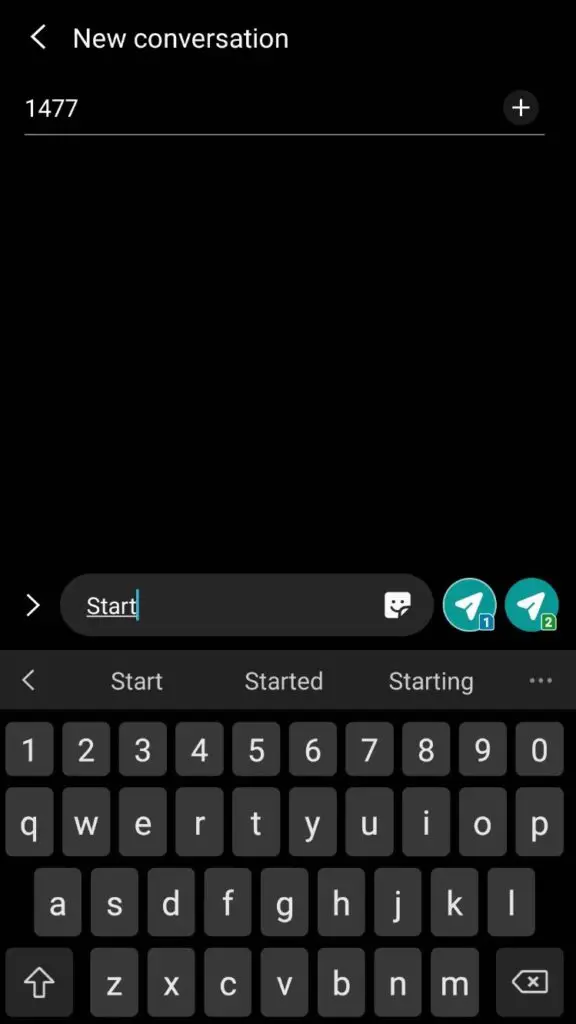

- Go to your message box

- Type Start and Send it to 1477

- To learn about the status of the loan for eg. the amount, type ‘Status’ and send it to 1477.

- You can also terminate the loan service. For this, you can type ‘Stop’ and message it to 1477.

Another crucial feature of NTC is that the NTC Credit service allows the continuation of calls even when the NTC prepaid user runs out of balance. It is free of any extra charges or taxes. Only the same amount of loan is deducted from the main balance once the user recharges the SIM.

How to take a Loan on Ncell?

Ncell offers both USSD dial and message methods to get a loan or credit service. Check below for the steps to take a loan with a Ncell SIM card.

By USSD Dialing Method

- Go to dial and type *9988# and hit on call.

- You will get options to choose your loan.

- Select the one as per your need.

By Message

- Go to message and leave it blank then send the message to 9988.

- You will have your loan service activated.

The loan amount is paid off when you recharge your main balance. However, if you transfer the main balance which is lower than the loan, the whole amount will be deducted and the remaining loan amount will again be drawn from your next recharge. So make sure that your first recharge after the loan amount will clear out the loan amount at once and also leave enough main balance for calls and texts.

If you do not pay off your loan amount you will still receive incoming calls but the SMS feature will not be functional. To restore the SMS service you will have to pay off the loan amount out of your main balance.

Ncell Loan /Credit Service:

Ncell Axiata Limited (previously Ncell Private Limited) is the first private mobile service provider in Nepal which has been providing service since 2005.Ncell is the second-largest telecom operator in Nepal. Taking credit for Ncell is not that difficult either. We will break down the process below but first:

Feature of Ncell Loan Services:

- Only prepaid customers are eligible

- They must have used the SIM for 2 or more months

- You can take loan only when your balance is Rs. 5 or less

- Ncell reduces the credit amount in next recharge.

- There is no expiry date on the loan amount.

- If your loan amount uses up, you can not take another loan unless you clear out the current loan

We hope the article was helpful to you.

Related post: